Within the course of the last 9 months, Ethereum has lost around half of its value compared to Bitcoin. As a result, Bitcoin market cap dominance rose to over 57%, the highest value recorded since May 2021.

But what is actually causing this flaccid movement, and will Ethereum be able to perform again?

Let’s go through some of the most commonly quoted sources of this decline. This is not to point our finger at one source alone, but rather — to give you an overview over the various community concerns and their wider implication regarding Ethereum’s weak price action, and determine whether it’s do with Ethereum itself, or a wider industry trend.

Controversy Surrounding its founder Vitalik Buterin

People have speculated that Vitalik getting laid is having a bad influence over Ethereum, much like when Toby Maguire in Spiderman 2 decides to accept Venom and he acts all edgy and cool, but everyone hates him.

People speculates (half-jokingly) that Vitalik has started dumping Ethereum because of his girlfriend, as Vitalik most recent ETH dumps matches the narrative.

In reality though, Vitalik has been slowly offloading Eth since 2016

However funny a hero-turned-villain-because-of-pussy character arc might sound, that’s not it, as his recent off-loading of ETH is not out of the ordinary. There’s nothing wrong with taking some profits here and there as needed, however Vitalik denied him taking profits and has stated that his sell-offs are for the purpose of.

supporting various projects that I think are valuable, either within the Ethereum ecosystem or broader charity.

Ethereum Foundation Selloff

Regardless of this, Vitalik’s own selloffs are relatively small to the ones performed by the Ethereum Foundation itself. Again, similar to Vitalik’s approach, the foundation has been regularly selling Eth as and when required.

This is common practice and part of the foundation’s routine fund management. Here is a chart plotting EF sales over price since 2021.

Note, it doesn’t include the recent 35k ETH sell-off, which would be similar to the 3rd red candle in size.

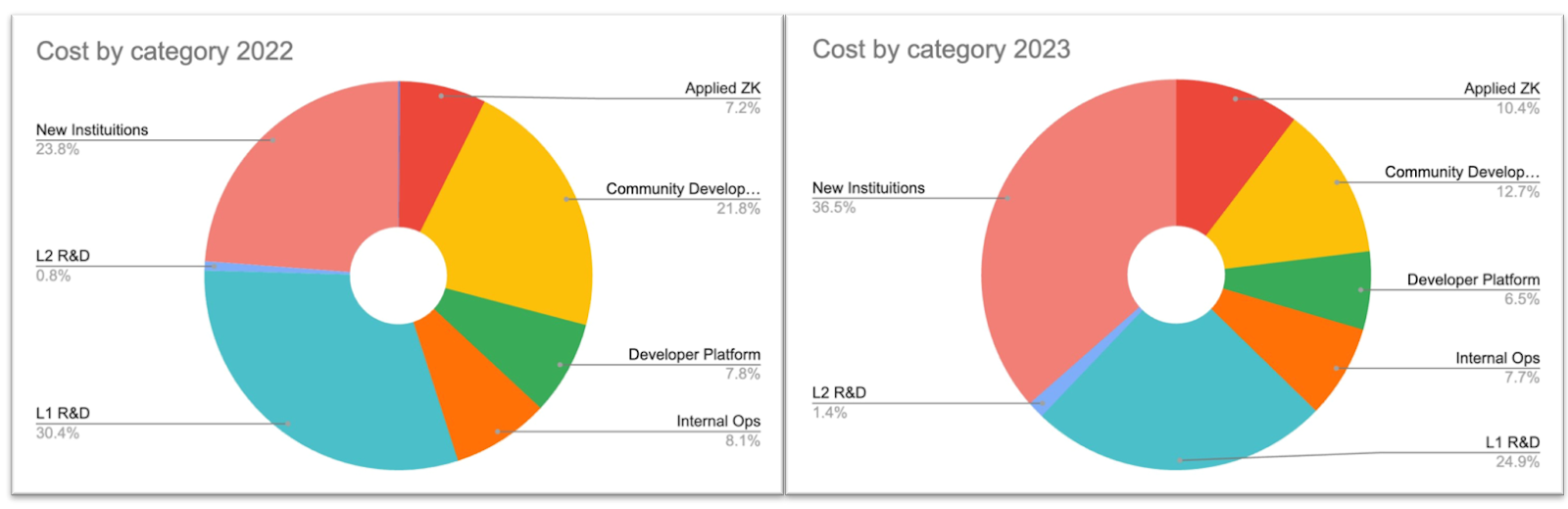

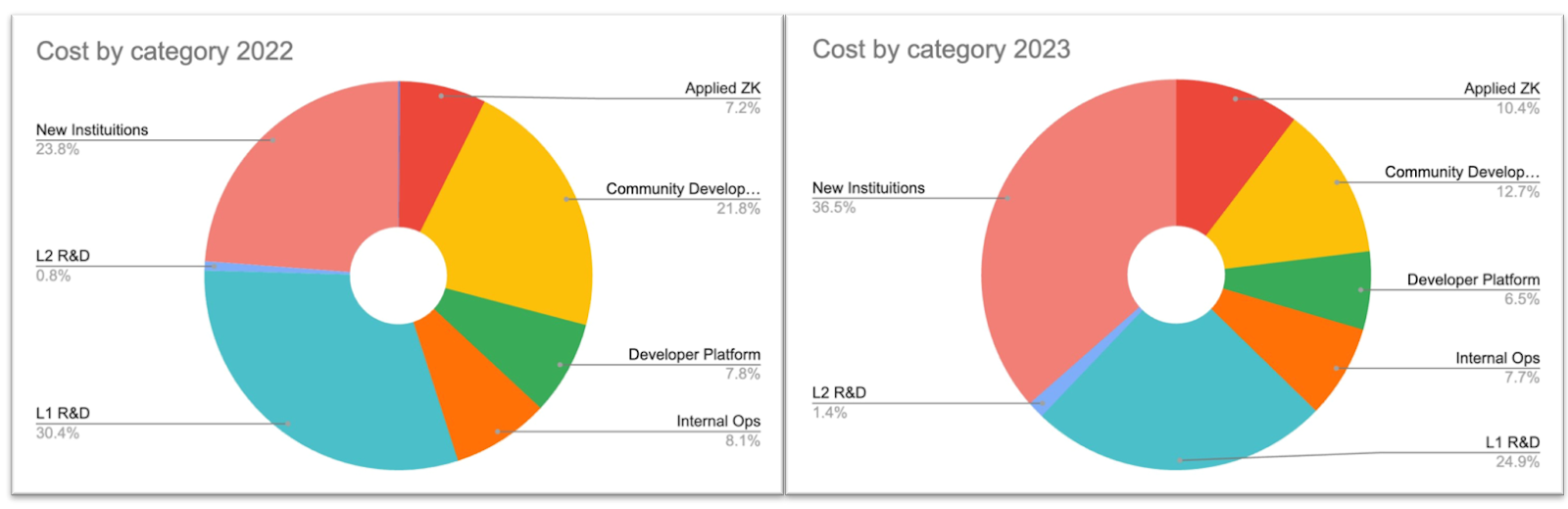

In a post made by Josh Stark of the EF provided we get a first glimpse of a breakdown of the Foundation’s spending for the last two years. He clarified, however, that the full details are expected to be published before Devcon 2024.

To sum up these 2 sections, neither Vitalik nor the Ethereum Foundation are doing anything outside of their usual MO. That is — ocassionally taking profits for various reasons. It’s just that the market itself is more emotionally invested as a result of the underperfomring quarter for Ethereum, and therefore it seems to have found a scapegoat they can take their frustrations on.

In a paradoxical way though, people mad at Vitalik and the foundation for selling Eth, which as we’ve seen, they’ve been doing so since 2016 are creating FUD which could potentially be enough to shake investor confidence and for investors to look rebalance into other assets with less drama and frustration surrounding it.

Is there hope for Ethereum?

No one can predict what’s going to happen — but let me rephrase the question.

Is there hope for the second most valuable crypto asset on the market? See how that sounds a bit silly?

Fundamentally, there is nothing “wrong” with Ethereum, Vitalik or the foundation. In fact, the underperforming trend against BTC is not exclusive to Ethereum. Here are some other examples:

DOT-BTC — 2024

DOGE-BTC — 2024

XRP-BTC — 2024

The only top alts that are performing well, or at least in line with BTC this year are SOL and BNB — but these are the exception, and not the rule.

When assets underpeform, it’s not necesarily a bad thing. If the asset is fundamentally strong and has a future, it means there’s potentially more opportunity.

From where I’m standing, this seems like a wider altcoin trend, which will eventually be broken once “altcoin season” starts.

That’s all I have for today! Remember to Clap(👏) and follow me for more.